For Gen X and Y professionals looking to close their retirement gap through business ownership, private equity’s massive presence in franchising is actually good news. In 2023 alone, franchising contributed $860.1 billion to the US economy and created 254,000 new jobs – with PE firms driving much of this growth.

Think of it this way: when private equity giants like KKR and Roark Capital invest billions in franchise systems, they validate the business model and create a professionally managed infrastructure that small investors can leverage. It’s like accessing institutional-quality investments but at a fraction of the cost.

Following the Smart Money: PE’s Growing Influence

The scale of private equity’s influence in franchising might surprise you. While PE firms have been dubbed “capitalism’s misunderstood entrepreneurs,” they’re now one of the biggest buyers of not just franchise brands but individual franchise outlets too. Prominent household names like Neighborly (owned by KKR), Inspire Brands (Roark Capital), and Authority Brands (Apax Partners) are just the tip of the iceberg.

This trend is particularly interesting for individual investors because it creates multiple paths to success. Nearly 88% of public pensions in the US have some exposure to private equity – meaning over 34 million Americans are indirectly betting on franchising’s success. It’s worth paying attention when sophisticated institutional investors put this much faith (and money) in a business model.

Even more telling is that we’re far from saturation. With more than 9,200 private equity firms worldwide and franchising contributing just 3% of US GDP, there’s still substantial room for growth. For professionals looking to build their retirement safety net, this means entering a market mature enough to be stable yet young enough to offer significant upside potential.

Why PE Firms Are Betting Big on Franchising

What attracts private equity to franchising isn’t just the scale – it’s the business model itself. Consider it a subscription model for the real world: franchisors collect recurring royalty revenue like software companies collect monthly subscription fees. However, unlike tech startups that might take years to become profitable, established franchise systems often provide immediate cash flow.

PE firms typically aim for a 3-4x return on their invested capital, and franchising has proven it can deliver. The secret sauce? Something called “multi-brand platforming.” Take the example of ServiceMaster in the 1980s and 90s – they started with one successful service brand and then systematically acquired complementary businesses like Merry Maids, Terminix, and TruGreen. Building a family of related brands creates economies of scale while serving a common customer base.

For individual investors, this PE playbook offers a valuable lesson. When you invest in a franchise system backed by private equity, you’re not just buying into one business model but potentially accessing a growing ecosystem of complementary brands and services.

The Numbers Behind the Transformation

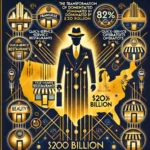

If you think small, independent owner-operators still dominate franchising, think again. Today, approximately 44,000 multi-unit operators (MUOs) control more than half of all franchise units in the US and drive $200 billion in sales. And in some sectors, the concentration is even more dramatic – MUOs control 82% of quick-service restaurants and 78% of beauty-related franchise outlets.

What’s even more telling is the rapid pace of consolidation. While the average MUO owns 5.2 locations (up from 4.8 in 2011), the real story is at the top end of the market. The number of operators with more than 50 units skyrocketed by 114% from 2010 to 2020, making it the fastest-growing category of franchisees. The most significant player, Flynn Group, now operates nearly 2,600 units and employs its own data scientists to optimize operations.

This trend toward larger, more sophisticated operations creates a fascinating opportunity for strategic investors. You don’t need to start with 50 units – but understanding that the industry is moving in this direction helps inform your growth strategy. PE firms are creating a blueprint for success that smaller investors can study and adapt.

What This Means for Individual Franchisees

Private equity’s influence brings several key advantages for professionals considering franchise ownership as part of their wealth-building strategy. First, it’s creating more exit opportunities. Take the example of Dunkin’s largest Florida franchisee, who sold all 100 units to Exeter Capital in 2022. PE firms are now among the biggest buyers of franchise outlets, creating crucial new exit options for retiring franchisees.

But perhaps more importantly, PE involvement tends to strengthen the overall franchise system. These firms are committed to following franchise best practices, including having their management teams earn Certified Franchise Executive credentials. They bring professional management, sophisticated systems, and data-driven decision-making that benefits all franchisees in the network.

The proof is in the numbers: franchisee interest in expansion is considered a critical barometer of system health and profitability. When PE-backed systems show strong unit growth and high franchisee satisfaction, it validates that the model works not just for big investors but for individual operators too. Think of it as having institutional-grade support while running your own local business.

Strategic Moves for Today’s Investor

As we’ve seen, private equity’s growing influence in franchising isn’t something to fear – it’s something to leverage. For Gen X and Y professionals looking to close their retirement gap, this transformation of the franchise landscape creates unique opportunities to build wealth through strategic business ownership.

The key is understanding that today’s franchise investments come in many forms. You can start small and grow strategically, operate actively or choose a semi-absentee model. You can even build a portfolio of complementary brands, just like the PE firms do, but at a scale that makes sense for your goals and resources.

Most importantly, you’re not just buying a business – you’re buying into a proven system continuously optimized by some of the brightest minds in finance and operations. One industry expert noted, “The man at the mountain didn’t fall there.”

So whether you’re looking to make a 100% passive investment in something like the Amazon Flywheel program or step into an innovative, tech-forward franchise like Get A Grip, the opportunity to build your modern pension plan has never been more accessible.

Want to learn more about leveraging these trends to build your wealth-creation strategy? Let’s have a conversation about what this could look like for you. Book a call here to explore your options.

Remember, Life is Better Without A Boss…Unless It’s You.

This article was inspired by insights from “Big Money in Franchising: Scaling Your Enterprise in the Era of Private Equity” by Alicia Miller (2024).